Written by: Luca Grispiani

LCOE Wind Park

The aim of this section is to provide a preliminary financial analysis of the Wind Park expressed in terms of the Levelized Cost of Energy. The financial analysis has been mainly developed based on the work “Levelised cost of energy for offshore floating wind turbines in a life cycle perspective”, carried out by Myhr in 2014 [1] and implementing an Economical Model developed by Heidarim [2].

The overall cost of the project is composed of the CAPEX (Capital Expenditure) and the OPEX (Operational Expenditure). Therefore, considering a life cycle of 20 years, the total cost of the project outcomes equal to 4.36 bn £, as shown in the following table.

The overall cost of the Wind Park from a lifecycle perspective.

Project Development £ 150'000.00 £/MW £ 150'000'000.00

Wind Turbines £ 1'100'000,00 £/unit turbine £ 1'100'000'000.00

Substrucure £ 3'720'000.00 unit turbine £ 372'000'000.00

Mooring and Anchoring System £ 136'000.00 per unit installed anchor

(4 anchor each turbine)£ 81'600'000.00

Electrical Interconnection £ 115'700.00 £/MW £ 115'700'000.00

Installation cost £ 459'000.00 £/MW/unit turbine £ 459'000'000.00

Insurance during Construction £ 38'000.00 £/MW £ 38'000'000.00

Contingency .+10% £ 231'630'000'00

CAPEX £ 2'547'930'000.00

O&M Cost £ 75'000.00 £/MW/year of operation £ 1'500'000'000.00

Insurance during Operating Phase £ 15'600.00 £/MW/year of operation £ 312'000'000.00

OPEX £ 1'812'000'000'00

CAPEX + OPEX £ 4.359.930.000,00

Remarkable to highlight that the electricity output from the Wind Park is not delivered to shore through expensive exporting cables because it is used to supply electricity to the integrated offshore platform for hydrogen production. In this way, the electrical interconnection cost is reduced by more than 60%.

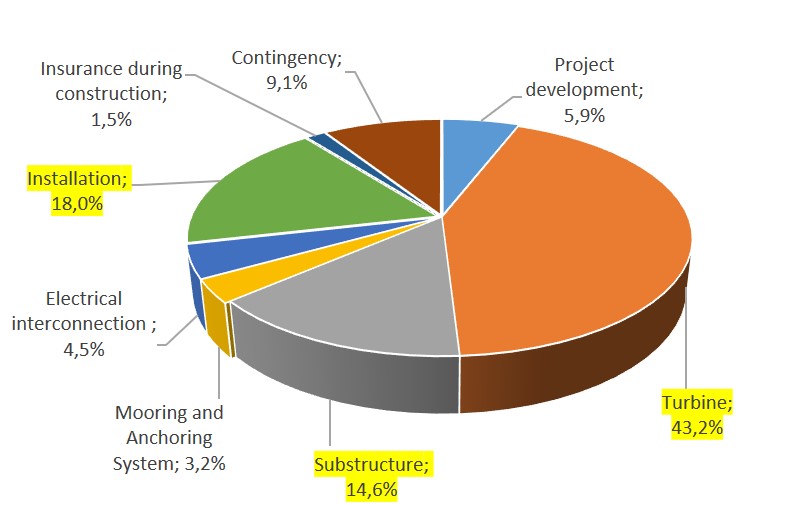

The pie chart below shows the subdivision of the CAPEX value, where the largest cuts are dedicated to the cost for the turbines, substructures, and installation. All of the 3 combined covers more than 45% of the total cost of the project.

Pie Chart representing CAPEX value.

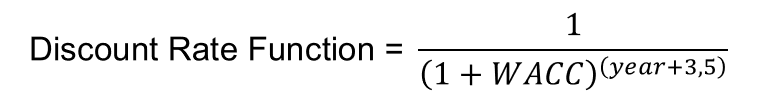

Therefore, having assessed the total power output from the Wind Park and its overall cost, a proper calculation of the LCOE for the Offshore Wind Farm is conducted by defining a DiscountRate Function, expressed below.

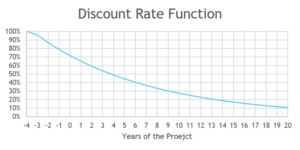

This simplified expression of the Discount Rate Function considers the factor Weighted Average Cost of Capital WACC, that has been fixed at 10.10%, however in a real project it shall be estimated accurately since it takes into account several financial aspects, such as Equity, Cost of Debt, Tax Rate and others. Thus, as the WACC is a fixed value, the Discount Function depends exclusively on the relative year during the advancement of the project. In this work, the term year varies from -4 to 20, considering the 4 years period of development of the Wind Park Project before the actuation for the lifecycle period.

The trend of Discount Rate along with the project advancement.

The trend of Discount Rate along with the project advancement.

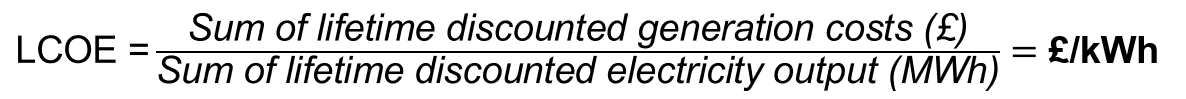

Finally, the LCOE is calculated as the ratio between the cumulative Discounted Energy Generation and the cumulative Discounted Annual Cost, as shown in the following equation:

The implementation of the equation above can be explained with an example. With regards to the year of project development -1, the specific costs have been assessed as 10% of the “project development”, plus 50% of “Turbines” cost, plus 50% of “Substructure” cost, plus 40% of “mooring and Anchoring System” cost, plus 20% of “Electrical interconnection” cost, plus 30% of “Installation” cost and in addition 33% of “Insurance during construction” and “Contingency”. Therefore, the overall cost of during the year of project development -1 corresponds to £ 1.034’356’666.67, while the discount rate is equal to 0,786. Thus the discount cost outcomes for £ 813.208.707,98. On the other hand, the power output is null during construction.

Considering the year of project development +3, the discount rate is equal to 0,535. Therefore, the relative discounted power output outcomes 2808100,61 MW*h/year, while the discounted generation cost corresponds to an annual OPEX time the discount rate, which is equal to £ 48.474.197,10.

The cumulative values related to each year of project development constitute the two terms of the question above. More details can be consulted here.

As a result, the Levelised Cost of Energy from the Wind Park implementing the Discount Rate Function outcomes equal to 79 £/kWh (7,9pence/kWh), which is a very competitive value compared to other forms of Energy Generation.

References

[1] Levelised cost of energy for offshore floating wind turbines in a life cycle perspective, A. Myhr at others, Renewable Energy 66 (2014) 714e728

[2] Economic Modelling of Floating Offshore Wind Power – Calculation of Levelized Cost of Energy, Mälardalen University (Sweden), Shayan Heidarim, MSc thesis, School of Business, Society and Engineering. http://dx.doi.org/10.1016/j.renene.2014.01.017

[3] Levelised cost of energy – A theoretical justification and critical assessment, J. Aldersey-Williamsa & T. Rubertb, Energy Policy 124 (2019) 169–179, https://doi.org/10.1016/j.enpol.2018.10.004