Policies and Incentives

Policies and Incentives

The European and UK governments have introduced a number of taxes and incentive schemes to encourage the reduction of greenhouse gas emissions. The schemes included in the feasibility study are described in the following sections.

Taxes

The electricity price delivered is subject to a number of additional costs which have been listed below.

These costs have been included in the electricity price used to determine the electricity savings for the project.

Climate Change Levy (CCL) – Included in the electricity price, this takes into account the CCL exemption for the GSK Irvine site, under the CCA.

Carbon Price Support (CPS) – Included – part of the Carbon Price Floor mechanism.

The gas price delivered is also subject to climate change levy.

CHPQA

New CHP schemes can obtain the CHP QA certificate if their electrical efficiency is greater than 20% and if they have a Quality Index greater than 105. Modelling based on the data provided highlights the plant would achieve both the ‘standard’ CHPQA and the CHPQA GN44 which is required for the RHI/ROC uplift.

If so they can benefit from the following incentives:

Enhanced Capital Allowance (ECA): offers 100% first year tax relief on CHP plants if the RHI is not claimed. This additional benefit of around £20m has not been accounted for in the simple payback analysis of this study.

Business Rates Exemption: It is likely that the biomass will be able to obtain a business rates exemption on the power generating elements of the scheme. The current modelling approach is to take a conservative view, and therefore the model has assumed that GSK will have a full increase in business rates.

EU ETS

Since biomass is considered to be carbon neutral under the EUETS scheme the amount of greenhouse gas emissions from the Irvine Site will be significantly reduced resulting in a financial benefit under EU ETS.

Renewable Heat Incentive (RHI)

The Renewable Heat Incentive is a subsidy mechanism similar to the Feed In Tariffs scheme which aims to significantly increase the level of renewable heat. The government estimates that by 2020 12% of heating could come from renewable sources and that the RHI could save up to 44 million tonnes of carbon (MtCO2).

The combustion of biomass in dedicated biomass boilers is eligible to the RHI. Boilers exceeding 1 MWth (as considered in Irvine) fall in the large scale biomass category. Support levels for biomass are currently 2.0p/kWh for dedicated biomass plants, and this is raised to 4.1p/kWh for the heat produced in a CHPQA accredited biomass CHP installation. The RHI is administered by Ofgem who will therefore deal with the accreditation process, ensuring compliance and making incentive payments. Payments will be done on a quarterly basis following the submission of the required periodic information. One of which would be to report on the sustainability of the biomass feedstock source. Such sustainability certificates will be issued by the biomass suppliers.

ROCs and CfD Support

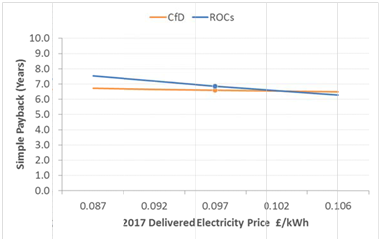

Two support mechanisms exist for the Biomass CHP Scheme; Renewables Obligation Certificates (ROCs) and Contracts for Difference (CfDs). The lifetime of support under ROCs is 20 years from commissioning, whereas for CfD it is only 15 years.

One ROC is awarded for every 1MWh of renewable electricity generated. It is possible to gain additional ROCs under the ROC Banding scheme, where different technologies are awarded different levels of support, or ROC bands. Electricity from Biomass CHP is awarded 1.4 ROCs per 1MWh of renewable electricity generation.

The technical modelling based on data from AET and from thermodynamic first principals shows that the proposed Biomass CHP achieves the GQCHP GN44 accreditation. This means it is eligible for uplift to 2.0

ROCs per MWh or RHI support on the heat output, not both. The modelling shows that opting for the RHI is the most economic option for this project.

CfDs are due to come in in 2014 as an alternative to ROCs. For plants commissioned after the 31st March

2017, CfD will be the only option for renewable electricity generation. CfD support is based upon a Strike Price (currently £125/MWh for Biomass CHP). The level of income for the project is calculated by the difference between the strike price and the wholesale electricity price. This means that as wholesale electricity costs rise, the level of support under CfD falls.

The cross‐over point between ROCs and CfD for this biomass CHP project is when the wholesale electricity price reaches approximately £100/MWh. Above this price; ROCs provide a higher level of income for GSK. Please note that the CfD is currently under consultation, and may be liable to change after the publication of this report.