Discussion

A hydrogen peak power plant system was envisaged, and a tool was created to assess the plant’s financial viability under various scenarios.

The output from application of the tool, has found that for many scenarios, the annual income from the sale of electricity, and availability payments, are not sufficient to cover annual running costs. This is the case for all scenarios in current circumstances. This is not unexpected, as an immature technology, for which there is not currently a market, is likely to be prohibitively expensive. However, some future scenarios were devised with different circumstances. In some scenarios, the plant had an annual surplus, i.e. its income from sale of electricity and availability payments, more than covered running costs. Further investigation of these results compared the capital which could have been raised, based on projected annual surplus and standard financial parameters. In most cases, the annual surplus was not sufficient to pay the necessary loan to buy the equipment in the first place. However, some scenarios were identified in which the plant could raise enough money annually to pay for the necessary loan. These were scenarios representing a potential future:

Most viable scenarios (see Results - H3P page): “A20” – Aggressive demand pattern – calls on 3 consecutive days every week, electrolyser and compressor of capacity to refill hydrogen store in 20 hours. “M20” – Moderate demand pattern – calls on 3 days per week, over a day apart, every week, electrolyser and compressor of capacity to refill hydrogen store in 20 hours. Effects of different parameters

This is slightly surprising, as a faster refill rate allows purchase of the cheapest electricity. However, the additional capital and running costs associated with more powerful equipment more than outweighed any price advantage. Should capital costs fall very significantly, this pattern could change in the future.

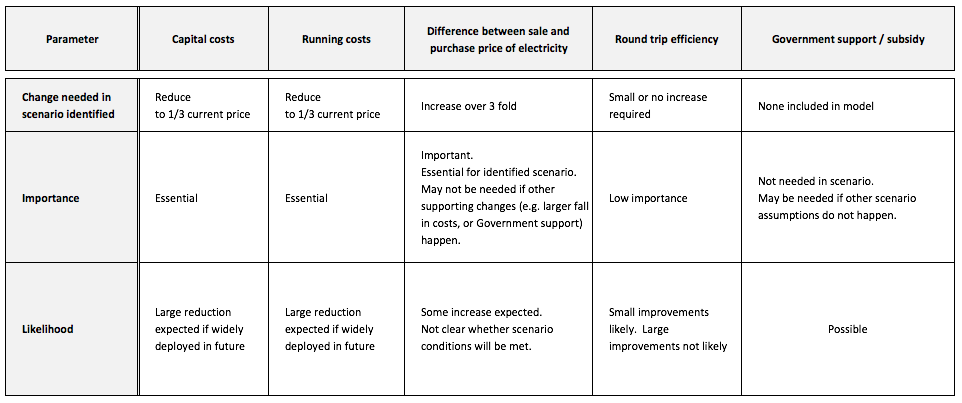

Comments on likelihood of various scenarios

Thus, a three-fold or greater fall in the price of capital equipment is not considered unlikely over coming years, if this type of equipment becomes widely used.

However, it is less clear if the price differences will reach those in the above scenario: such evaluation is beyond the scope of this project.

However, as the financial performance is fairly insensitive to efficiencies, particularly if the electricity is purchased very cheaply, this is not an important factor in future viability of this plant.

It has been suggested that emerging storage technologies would have been better placed in the Contracts for Difference part of the Electricity Market Reform, where, along with emerging renewable generation technologies, they could benefit from financial support. [6] For comparison, the most immature renewable generation technologies, wave and tidal, have enjoyed a strike price of £300/MWh under CfD [7]. If such a strike price was agreed, in the future, for immature storage technologies, that would provide the major part of the required high sale price of electricity. Another scenario would be for more modest support, such as £70-£100/MWh which have been applied to wind generation [7]. If our plant was supplied from renewables which might otherwise be curtailed, a future policy may allow financial support via a strike price for the actual generation which supplies the plant. Alternatively, some kind of grant may be awarded towards capital costs (currently >£10M, in the future, these may reduce to a few £million), or annual running surplus (of the order of £300k in several cases). In short, without attempting to predict future Government energy policy, it would not be surprising if some form of financial support, possibly significant, becomes available in the future.

Other factors

Other applications of the H3P plant, such as in transport as described in another section, could significantly add to its financial viability. Further electrification and or use of hydrogen in transport may help UK Government (and others) meet international targets on air quality and decarbonisation, and may also contribute to reduced reliance on imported liquid fuels. Support for, and greater uptake of these technologies, is not unexpected. Other niche applications for this type of plant may also add to markets.

Furthermore, the viability of this plant may not be decided on its raw financial performance alone. Practical considerations may become important, as the grid infrastructure needs to respond to the challenges posed by the closure of older power stations alongside increasing demand. This type of small modular energy storage plant could be relatively quick and simple to build, if the technology becomes established, and it would not be expected to need complex the planning and permitting permissions of large thermal plant. The plant’s environmental credentials (real or perceived), and its acceptability to the public, may also become increasingly important. For example, there is a large protest movement against “fracking” in the UK at present, which is hindering the easy rapid deployment of shale gas extraction UK wide [8]. An hydrogen peak power plant will need to maintain an impeccable safety record, and may need to make its “environmental case” clear, to enjoy public approval. [1] Solvay. (2012). Solvay has successfully commissioned the largest PEM fuel cell in the world at ColVin's Antwerp plant.

Available: http://www.solvay.com/en/media/press_releases/20120206-fuelcell.html [2] Siemens. (7 July 2015). World's largest hydrogen electrolysis facility. Available: http://www.siemens.com/innovation/en/home/pictures-of-the-future/energy-and-efficiency/smart-grids-and-energy-storage-largest-hydrogen-electrolysis-facility.html [3] APX power spot exchange. (2015). UKPX RPD historical data - Reference price data HH 2H 4HB 2015.xls. Available: http://www.apxgroup.com/market-results/apx-power-uk/ukpx-rpd-historical-data/Available: ftp://ftp.apxgroup.com/ [4] DECCC / DUKES. (2015). Digest of UK Energy Statisitics 2014/2015. Chapter 6: Renewable sources of energy. Available: https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/450298/DUKES_2015_Chapter_6.pdf [5] P. Millet, PEM water electrolysis. In: "Hydrogen production by electrolysis" ed. Godula-Jopek, A. Weinheim, Germany: Wiley, VCH, 2015. [6] House of Lords Science and Technology Select Committee. (2015). The Resilience of the UK Electricity System. Available: http://www.publications.parliament.uk/pa/ld201415/ldselect/ldsctech/121/12104.htm#a8 [7] DECC. (2015). Electricity Market Reform: Contracts for Difference. Available: https://www.gov.uk/government/collections/electricity-market-reform-contracts-for-difference [8] Frack off: extreme energy action network. (2015). Available: http://frack-off.org.uk/locations/ |

H3P PROJECT - Modular Peak Power Plant