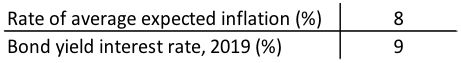

For financial calculations dynamic return indicators such as the net present value (NPV) are calculated according to international methods (Brealey et al., 2012). The applied interest rate and inflation rate for the calculation of the time value of the dynamic financial indicators were determined based on previous studies performed in Pakistan (Khalid et al., 2013).

The annual cash flow for both systems is calculated as the sum of the household electricity costs after 15 years of operation. In this case, the NPVs have a negative value after 15 years. The calculation considers capital cost, installation cost, maintenance cost, replacement cost, fuel cost, salvage and grid purchases. The grid purchases were calculated considering the peak and off-peak price of electricity applied in the area of study (NEPRA, 2017).

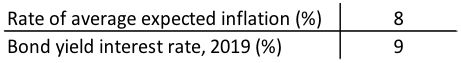

The following boundaries shown in Table 1 and Table 2 are applied to this analysis. Table 1 presents the economic aspects considered for the supply analysis.

Table 2 presents the calculated capital costs, annual maintenance costs, annual fuel costs and annual grid purchases. The capital costs for PV systems with storage are expressed in ranges because it depends on specific settings when sizing the PV system. Analysis on these features is presented in the technical analysis section.

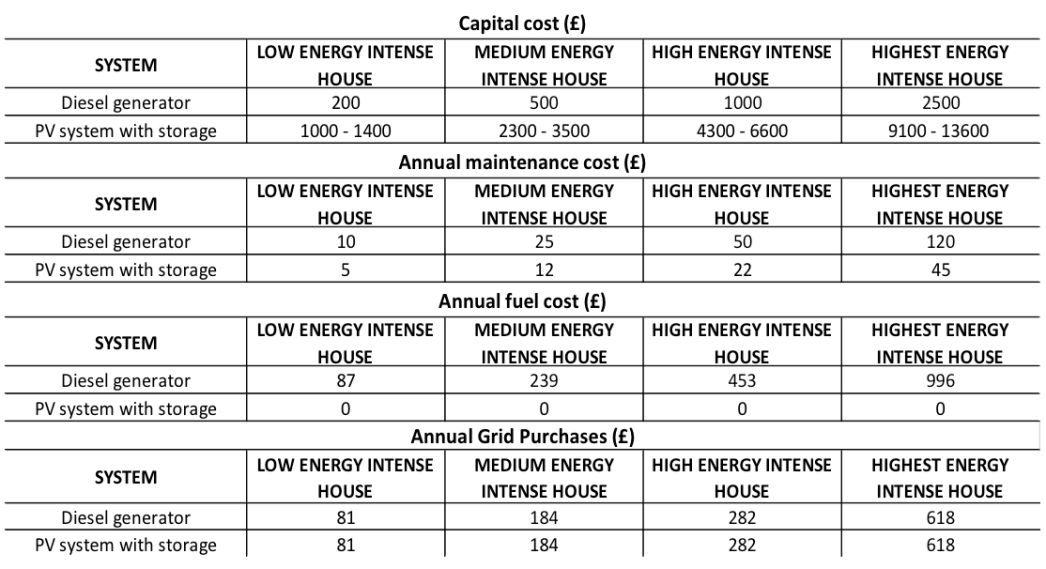

The NPV of the PV systems and storage with different DoD are calculated to evaluate the influence of the size of the battery bank on the cost to keep the system running after 15 years. The calculations are performed considering the boundary limits presented in the previous section. Figure 1 displays the results for the evaluation of NPV for PV systems with different DoD within a 15-year period.

Figure 1 shows that the NPV increases as the maximum DoD decreases. With this result, it is possible to evaluate the impact that high inflation and interest rates have when sizing the PV system. In countries with high inflation and interest rates, the value of money along the years changes dramatically, so minimizing the size of the battery bank allowing a higher DoD would be advantageous even if it means reducing its lifetime. In this case, paying back the loan faster is more appropriate than having a reliable system for a longer period, so the PV system with storage – 75% DoD which means replacing the batteries more frequently is the selected option.

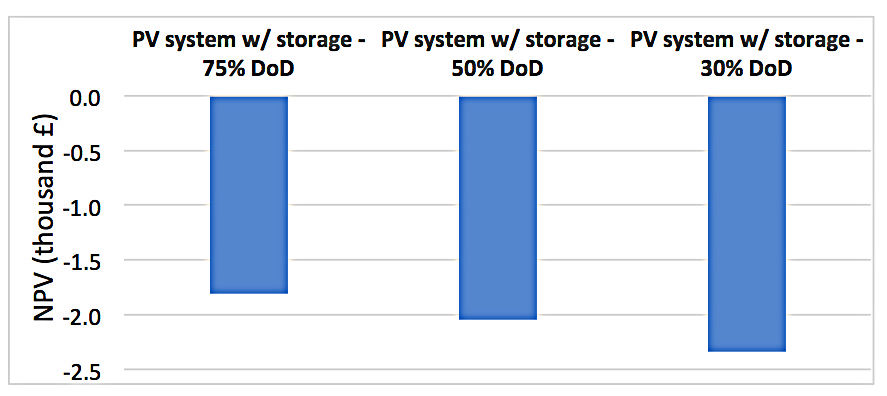

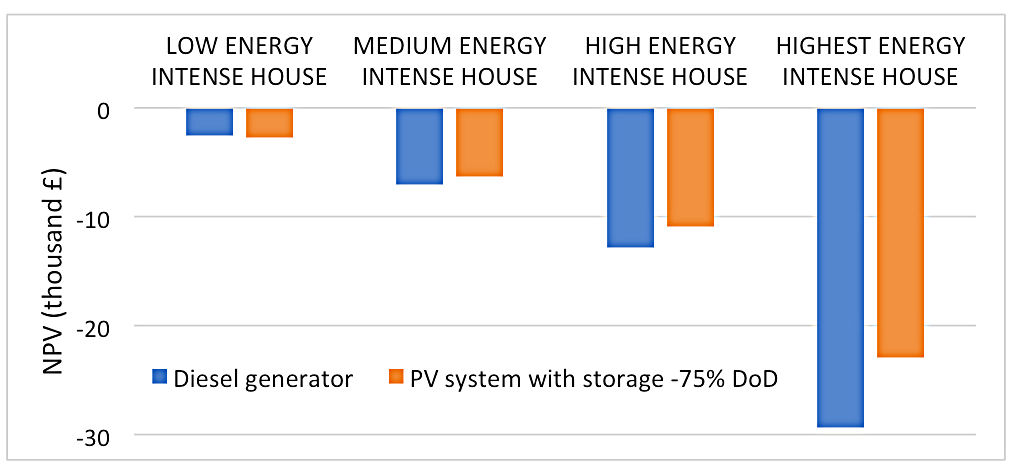

The NPV of the PV system with storage – 75% DoD and diesel generator are calculated to evaluate the cost to keep each system running after 15 years. The calculations are performed considering the boundary limits of previous section.

Figure 2 displays the results for the evaluation of NPV for PV systems with storage – 75% DoD and diesel generator for all four typical houses in Mian Channu within a 15-year period.

Figure 2 shows that for the low energy intense house, the NPV of both systems are very similar with the diesel generator as the most affordable option. On the other hand, for the case of - medium, high and highest energy intensive houses – the NPV of the PV system with storage - 75% DoD becomes the most affordable option with cost reductions reaching 20%.

As a result of the above investigation, it was found that even under high inflation and interest rates, PV systems can be an alternative solution for the use of diesel generator during load-shedding periods allowing savings of up to 20% considering a 15-year period.