electricity market reform

The UK Government launched a program called the Electricity Market Reform, which addresses the trilemma that the energy sector faces. As shown in Figure 1, these include:

The EMR program has been legislated for through the Energy Act of 2013. At the end of 2014 two key reforms were implemented in the energy market, Contracts for Difference (CfD) and Capacity Market (CM). [1]

- Decarbonising electricity supply

- Security of Supply

- Minimising the cost of energy to consumers

The EMR program has been legislated for through the Energy Act of 2013. At the end of 2014 two key reforms were implemented in the energy market, Contracts for Difference (CfD) and Capacity Market (CM). [1]

contracts for difference

Although not within the scope of the SEnS project, CfDs are designed to support new investment in all forms of low-carbon generation (renewables, nuclear, carbon capture, storage). Low carbon generation projects apply for CfDs and depending on the level of development of the project, it may have to compete to be awarded contracts. The contracts protect the low-carbon generation technologies from the volatility of the electricity price by providing a variable top-up price to meet a pre-agreed “strike price”.

capacity market

The Capacity Market however, is one of the main focuses of the project. The capacity market enhances the security of electrical supply and therefore addresses one of the points of the UK’s electricity supply trilemma. Capacity Market has also been integrated to ensure reliable source of electricity is available to meet a surge in demand. In essence the capacity market works as an insurance policy to keep the lights turned on [1].

short term operating reserve (STOR)

A key component that helps within the Capacity Market is the Short Term Operating Reserve (STOR). These reserves are used to help the national grid combat exceptionally high demand or cover normal demand in the case where a plant is unavailable. STORs operate as a contracted balancing mechanism.

In order to secure STOR supply, contracts need to be devised between the STOR operators and the National Grid. These contracts are set at a fixed selling price and as long as the STOR operator can meet the specified requirements the operator will be awarded a “standing fee” from the government.

The minimum requirements for a STOR operator are [4]:

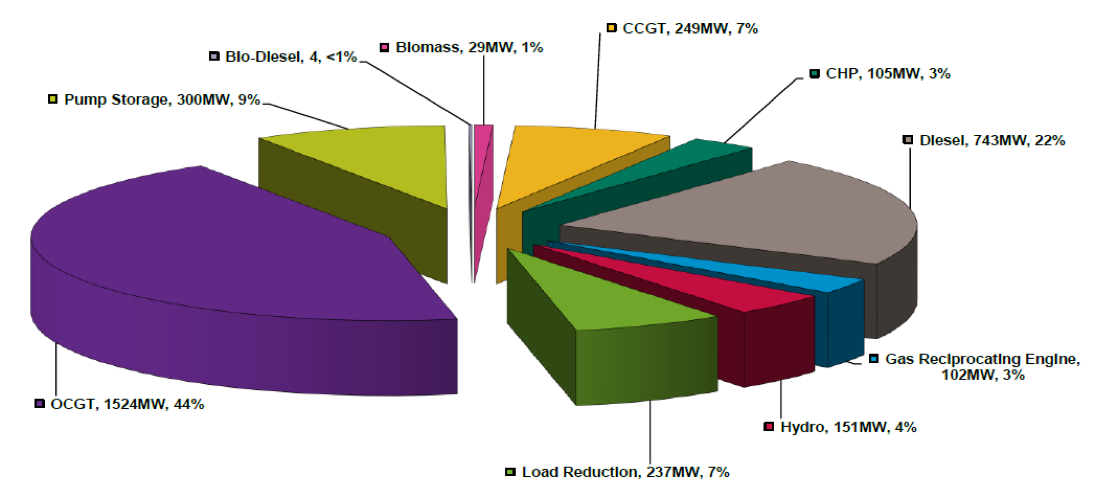

As graphically displayed in figure 2, currently, the STOR market is dominated by fossil fuel based generation types with few renewable, low-carbon or carbon free generation types being deployed.

In order to secure STOR supply, contracts need to be devised between the STOR operators and the National Grid. These contracts are set at a fixed selling price and as long as the STOR operator can meet the specified requirements the operator will be awarded a “standing fee” from the government.

The minimum requirements for a STOR operator are [4]:

- Minimum contract MW capability = 3MW.

- Contracted MW must be achievable no later than 240 minutes after instruction from National Grid. However 20 minutes response is competition level.

- Contracted MW must be deliverable for no less than 2 hours.

As graphically displayed in figure 2, currently, the STOR market is dominated by fossil fuel based generation types with few renewable, low-carbon or carbon free generation types being deployed.

Hydrogen Within CM and STOR

Hydrogen is an extremely flexible technology, we at SEnS aim to show how and when it may be financially viable to deploy Hydrogen within the STOR market.

Current progress of the hydrogen economy makes it a heavy financial burden and completely commercially unviable. However, it is our hope to show how great an impact hydrogen can have, not only on the STOR market, Capacity Market or National Grid, but also in the decarbonisation of the UK’s energy sector.

This means Hydrogen addresses 2 of the 3 issues of the UK’s energy trilemma; security and decarbonisation. However, as a fuel type Hydrogen technology address the all three aspects of the UK's electricity trilemma. Hydrogen is produced from a raw material that covers 71% of the earth surface: Water [6]. Although a lot of the water cannot be used direct from it's source, the UK has an abundant resource of fresh, clean water. The abundant nature of water means that the cost to consumers would come down extremely rapidly as the technology became fully integrated.

Current progress of the hydrogen economy makes it a heavy financial burden and completely commercially unviable. However, it is our hope to show how great an impact hydrogen can have, not only on the STOR market, Capacity Market or National Grid, but also in the decarbonisation of the UK’s energy sector.

This means Hydrogen addresses 2 of the 3 issues of the UK’s energy trilemma; security and decarbonisation. However, as a fuel type Hydrogen technology address the all three aspects of the UK's electricity trilemma. Hydrogen is produced from a raw material that covers 71% of the earth surface: Water [6]. Although a lot of the water cannot be used direct from it's source, the UK has an abundant resource of fresh, clean water. The abundant nature of water means that the cost to consumers would come down extremely rapidly as the technology became fully integrated.

Background

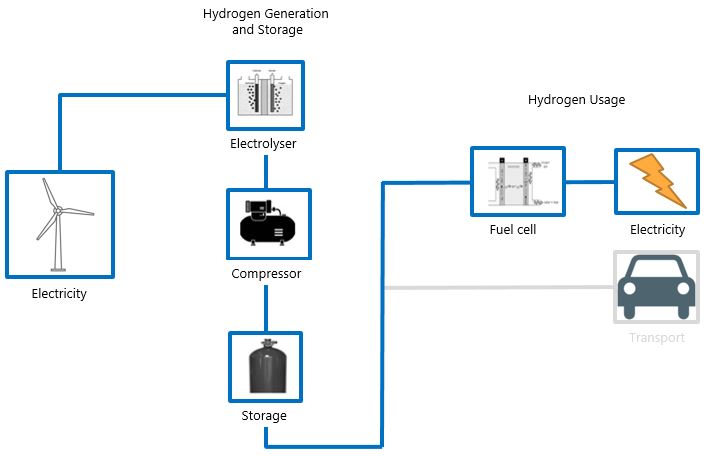

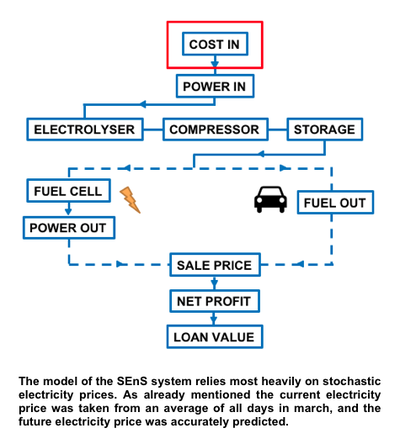

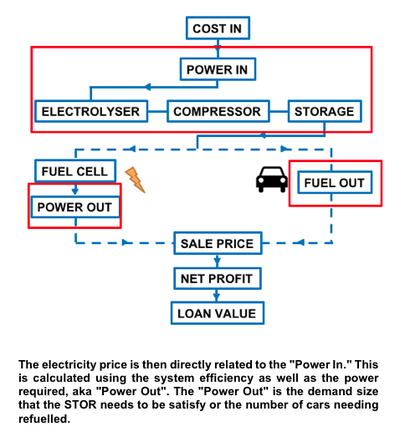

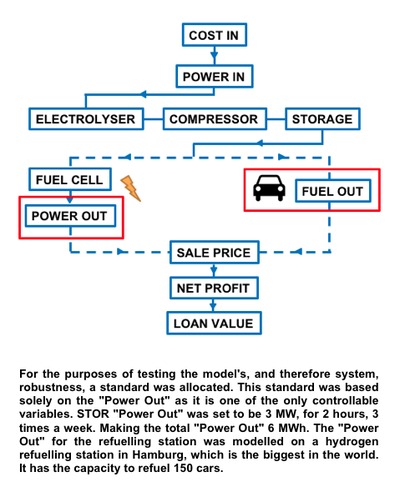

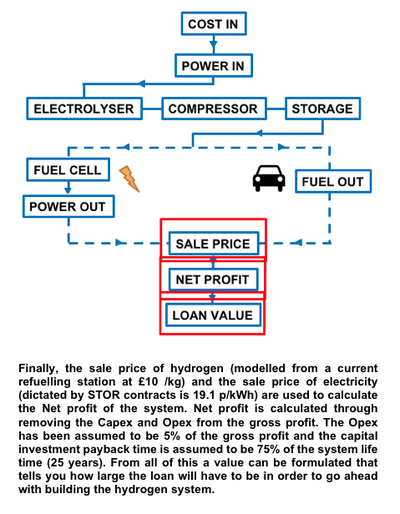

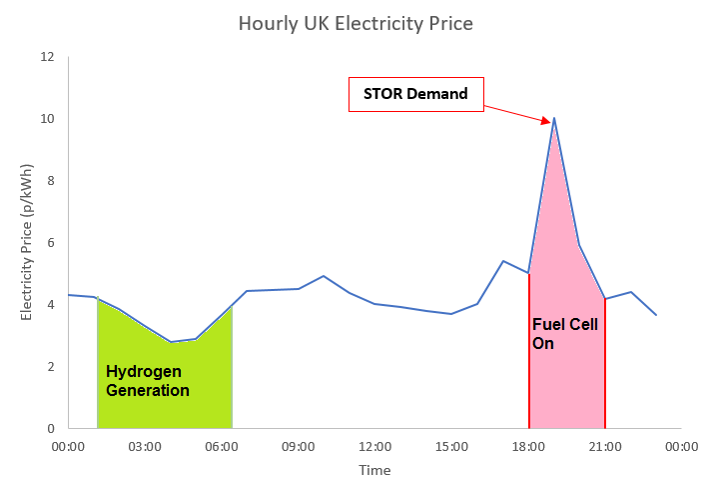

The hydrogen storage system model was tested in our primary application: Short Term Operating Reserve, displayed in Figure 3. The system was implemented as a balancing mechanism for the national grid and a financial feasibility study was carried out. Mathematical model was designed to accurately calculate the financial viability of meeting STOR market demand. The model’s robustness was then tested by altering fundamental variables like the stochasticity of electricity prices and demand size in order to simulate future scenarios.

How Will the System Work?

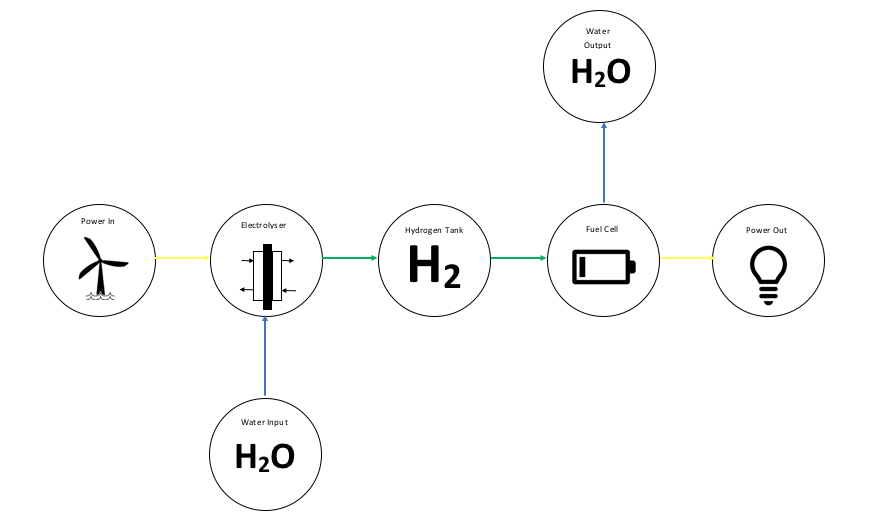

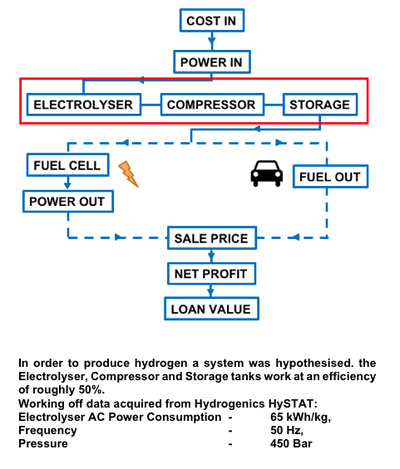

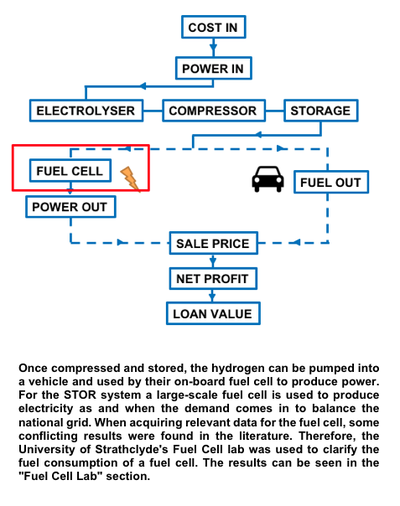

The system is based on the principles shown in the schematic diagram shown in Figure 4. The yellow lines indicate an electrical flow, blue lines water flow and green lines hydrogen flow. An input power, preferably generated from a curtailed renewable source, is utilised by an electrolyser were H2O is also fed into the system. Hydrogen is produced, compressed and stored in highly pressurised tanks. When required, the hydrogen is fed into a fuel cell to produce electricity, with the only other output being water.

The model takes into account different parameters such as the efficiency of the entire system; which was calculated at 30% overall efficient.

The model takes into account different parameters such as the efficiency of the entire system; which was calculated at 30% overall efficient.

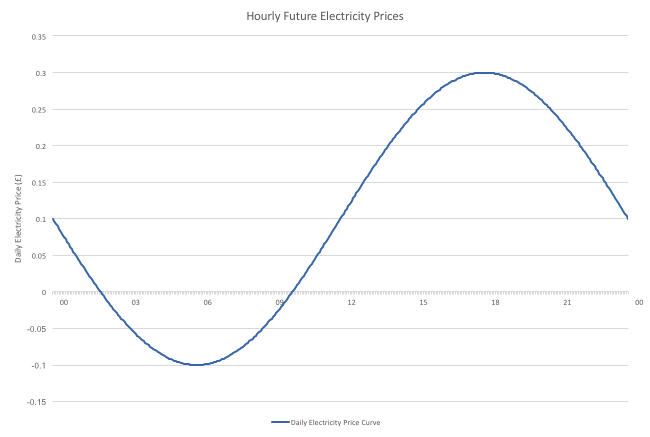

The SEnS system has been designed to test financial feasibility of the system for a future where the hydrogen economy can be successfully integrated. In order to test the robustness of the system several variables were altered to simulate future scenarios. The most complex of these variables to predict was the price of electricity over a 24 hour period, especially considering its extremely stochastic nature. Current electricity prices were acquired through NordPoolSpot.com, and an average of all days in March was taken.

In order to make an accurate and well informed prediction as to how the price of electricity would develop in the UK, and Scotland especially, many factors were taken into account:

A simple model was therefore created for expected future 24h electricity prices and this was used in the mathematical model.

In order to make an accurate and well informed prediction as to how the price of electricity would develop in the UK, and Scotland especially, many factors were taken into account:

- Increased generation through renewables will create a higher curtailment of electricity. This in turn will mean there are longer periods where electricity will be given away free, or at a negative cost to buyers.

- The situation that is currently being seen in the USA with regards to wind and in Germany with regards to solar is very similar to this prediction.

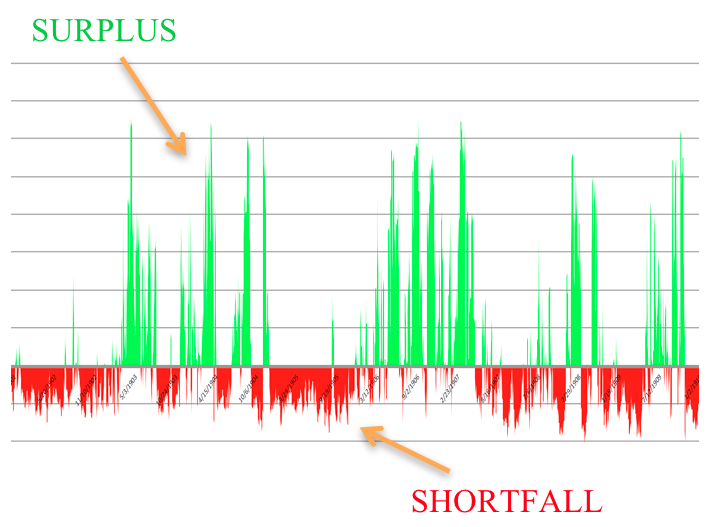

- A generation profile of the renewable capacity in Findhorn was used to show how much wind energy is curtailed due to large surplus energy production. This surplus would provide the SEnS system and model appropriate and optimal electrolysing times.

A simple model was therefore created for expected future 24h electricity prices and this was used in the mathematical model.

Future Electricity Price

In order to interpolate a future where renewables are more aggressive and electricity prices fall, several key pieces of information were reviewed. First we had to consider a future where renewables are more prominent and the effects this would have on demand and supply. This type of situation is what is happening currently in Germany with solar [7] and parts of the USA with wind power [8]. However, this energy is not being used to its full potential. Energy produced while there is no demand (surplus) is being curtailed, burnt off or sold to consumers for negative prices.

We at SEnS therefore believe a future UK, where there is more renewable generation online, will see much more surplus energy and increased curtailment of energy. However, we would use this electricity that would otherwise be curtailed to produce our hydrogen. We would run our system over night when electricity would be cheapest due to lowered demand, and therefore we would be able to meet STOR market demand at a lower cost incursion.

We at SEnS therefore believe a future UK, where there is more renewable generation online, will see much more surplus energy and increased curtailment of energy. However, we would use this electricity that would otherwise be curtailed to produce our hydrogen. We would run our system over night when electricity would be cheapest due to lowered demand, and therefore we would be able to meet STOR market demand at a lower cost incursion.

To implement this future electricity price, which was modelled on an increased renewable generation type like Findhorn (Figure 5), a 24 hour representation of electricity price had to be constructed, displayed graphically in Figure 6. This price curve would have to be lower, and briefly negative, at low demand times to take into account the otherwise curtailed electricity. It would also have to be more expensive at high demand times because it is predicted that demand will increase in the future due to the electrification of heat. Bearing all of this in mind, a simple electricity price curve was created to simulate that of future renewable generation scenario.

STOR MATLAB Model Results

Results for Today’s Prices were computed using the average daily electricity prices shown in Figure 7, which are averaged prices from the month of March 2017. Ideally, we would generate when the prices of electricity is the lowest, and then supply the demand whenever required as graphically shown. Figure 6 shows the price estimate for future electricity prices.

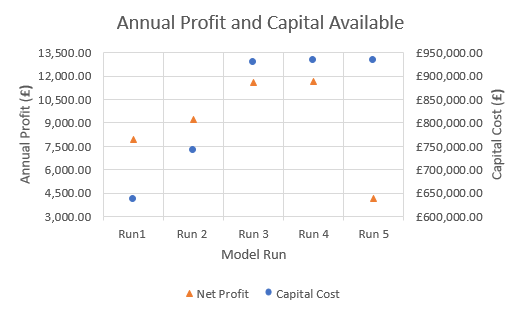

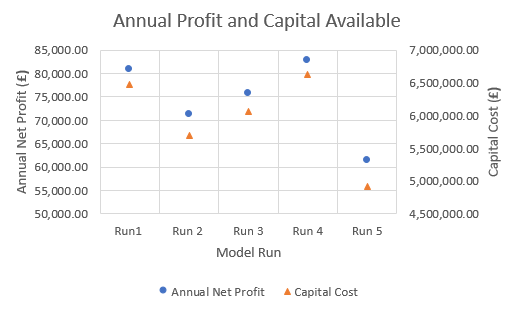

This model was based on the probability of having a much higher renewable generation in the future, resulting in negative prices. For each scenario, the MATLAB code was run a number of times, this was done to include a stochastic nature in the model itself. An average value was then computed for the Gross Profit, Net Profit and justifiable capital loan of the system. The following sections summarise the obtained results.

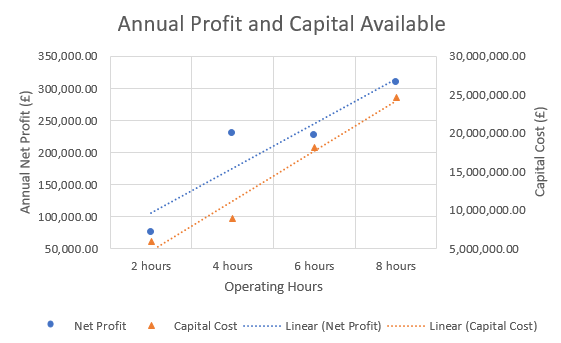

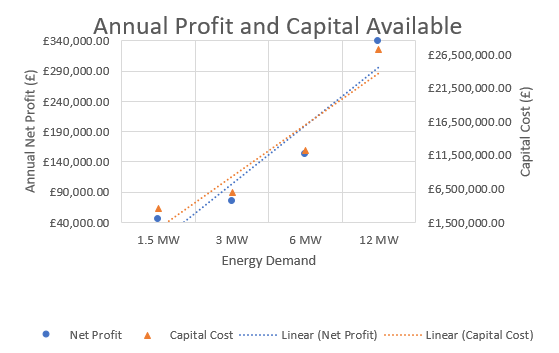

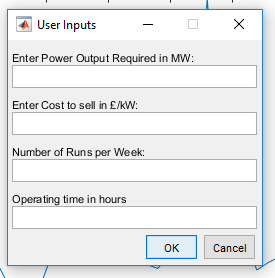

A Graphical User Interface was implemented where the user can input different data, such as required energy production, number of runs per week and price to sell the electricity. Different results for different were generated and these were carefully studied and discussed.

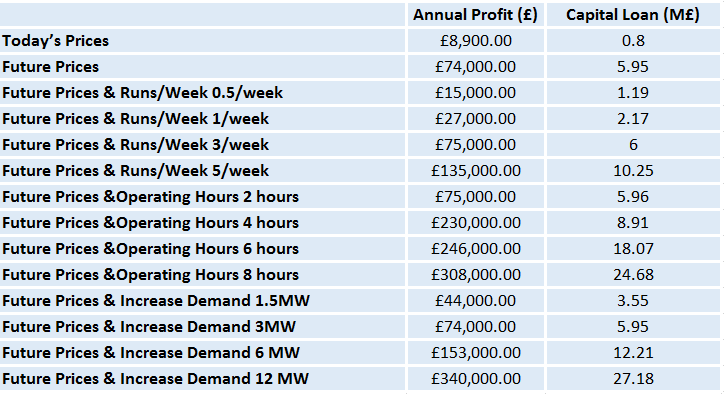

Table 1 summarises the obtained result. The File STOR_Results.pdf can be downloaded for a better description of all of the results obtained.

This model was based on the probability of having a much higher renewable generation in the future, resulting in negative prices. For each scenario, the MATLAB code was run a number of times, this was done to include a stochastic nature in the model itself. An average value was then computed for the Gross Profit, Net Profit and justifiable capital loan of the system. The following sections summarise the obtained results.

A Graphical User Interface was implemented where the user can input different data, such as required energy production, number of runs per week and price to sell the electricity. Different results for different were generated and these were carefully studied and discussed.

Table 1 summarises the obtained result. The File STOR_Results.pdf can be downloaded for a better description of all of the results obtained.

Obtained Results

- Today's Prices

- Future's Prices

The Annual Net Profit resulted in £74,000, 88% higher when compared with the current electricity prices. A justifiable Capital Loan of £5,950,000 resulted, this being 86% higher to that of current electricity prices, thus making the system more possible in a future with increased renewable generation.

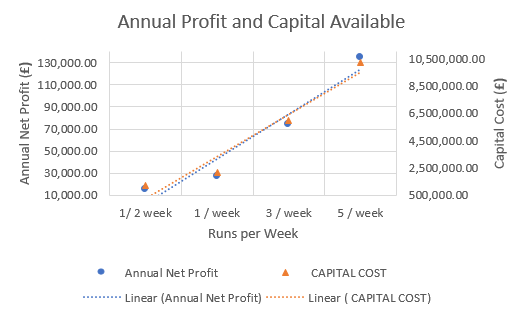

- Future's Prices & Different Number of Runs per Week

- Future's Prices & Different Operational Hours

- Future's Prices & Different Demand

MATLAB Code

The MATLAB code can be downloaded and applied to any desired application in five simple steps! The software package MATLAB R2017a or an updated version should be installed on the personal or desktop computer.

- Download the MATLAB Code STOR_Today.m (for today’s electricity prices) and STOR_Future.m (for future electricity prices).

- Download the excel files Present Prices.xlsx and Future Prices.xlsx

- Load the MATLAB code and run by pressing the play button displayed in Figure 13

- Provide the Data required by inputting the correct data in the GUI window displayed in Figure 14

- Run the same model inputting the same data for a desired number of times to get an average for the outputs

| stor_today.m | |

| File Size: | 4 kb |

| File Type: | m |

| present_prices.xlsx | |

| File Size: | 8 kb |

| File Type: | xlsx |

| stor_future.m | |

| File Size: | 4 kb |

| File Type: | m |

| future_prices.xlsx | |

| File Size: | 9 kb |

| File Type: | xlsx |

[1] http://www.energy-uk.org.uk/policy/electricity-market-reform.html

[2] https://www.linkedin.com/pulse/meeting-decarbonization-imperative-electricity-what-rowe-ceng-erp

[3] http://elwinlee.com/blog/2011/07/light-pollution-flickrtwitter-usage-in-europe/

[4] http://www2.nationalgrid.com/uk/services/balancing-services/reserve-services/short-term-operating-reserve/

[5] National Grid - Short Term Operating Reserve - Fuel Type Analysis Season 8.5

[6] https://water.usgs.gov/edu/earthhowmuch.html

[7] https://www.greentechmedia.com/articles/read/as-germany-curtails-wind-and-solar-billion-euro-grid-projects-seek-to-bring

[8] L. Bird, J. Cochran, X. Wang (2014). Wind and Solar Energy Curtailment: Experience and Practices in the United States. National Renewable Energy Laboratory [online] - www.nrel.gov/publications

[2] https://www.linkedin.com/pulse/meeting-decarbonization-imperative-electricity-what-rowe-ceng-erp

[3] http://elwinlee.com/blog/2011/07/light-pollution-flickrtwitter-usage-in-europe/

[4] http://www2.nationalgrid.com/uk/services/balancing-services/reserve-services/short-term-operating-reserve/

[5] National Grid - Short Term Operating Reserve - Fuel Type Analysis Season 8.5

[6] https://water.usgs.gov/edu/earthhowmuch.html

[7] https://www.greentechmedia.com/articles/read/as-germany-curtails-wind-and-solar-billion-euro-grid-projects-seek-to-bring

[8] L. Bird, J. Cochran, X. Wang (2014). Wind and Solar Energy Curtailment: Experience and Practices in the United States. National Renewable Energy Laboratory [online] - www.nrel.gov/publications