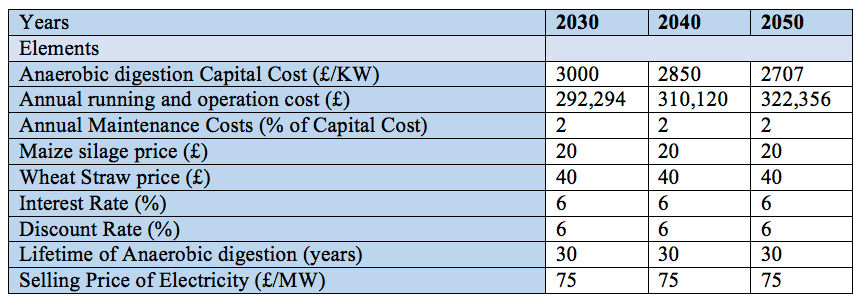

The values for elements presented in this part were based on current & future predictions for the costs of implementation of an anaerobic digestion plant for the years of 2030, 2040 and 2050. Despite it being impossible on accurately predicting these future values, since they depend on several different elements which cannot be controlled.

The capital cost which basically contains building, infrastructures and machinery capital has been estimated to be in the region of £2500 to £5000 for every kW of electricity generating capacity, an average of £3000 was then selected.

In addition, it was estimated that after 2030, the capital cost for every kW capacity will expected to decrease by 5 % (The Andersons Centre, 2010). Furthermore, from similar case studies, the maintenance cost of the anaerobic digestion is predicted to be fixed at 2% of capital cost (Clegg, 2017).

Moreover, the current electricity selling price is approximately £75/MWh which includes peak and off-peak selling price (NEPRA, 2018). The interest rate has been taken from the State Bank of Pakistan as 6%, with repayment loan payback period of 15 years (SBP, 2016). Also, the expected lifetime of typical anaerobic digestion was undertaken as 30 years. Likewise, according to the UK Market for Feedstock price, it was assumed that the average price for the maize silage is £20/tonnes, and for the wheat straw is £40/tonnes (PigWorld, 2019). Table 1 below reveals these considerations.

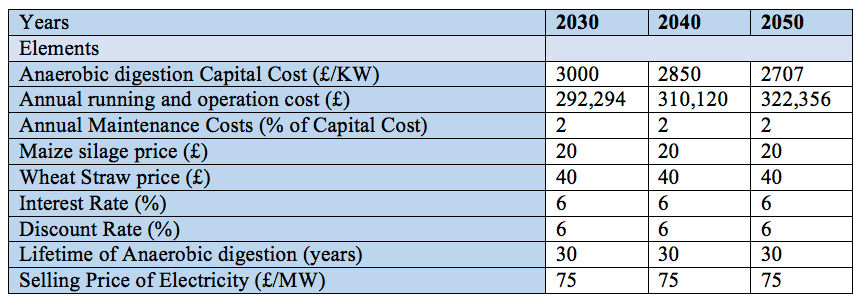

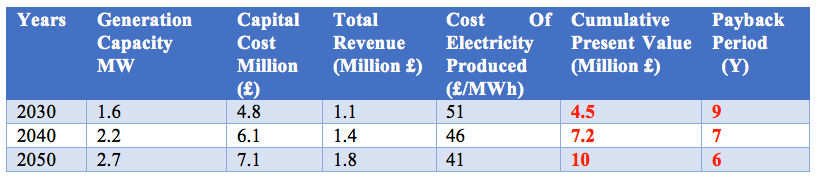

Using the boundary limits presented in Table 1 above, a detailed annual cash flow for the various generation capacities was simulated for the years 2030, 2040 and 2050 across the entire lifetime of the biogas plant. The result has been investigated and expressed in Table 2 below.

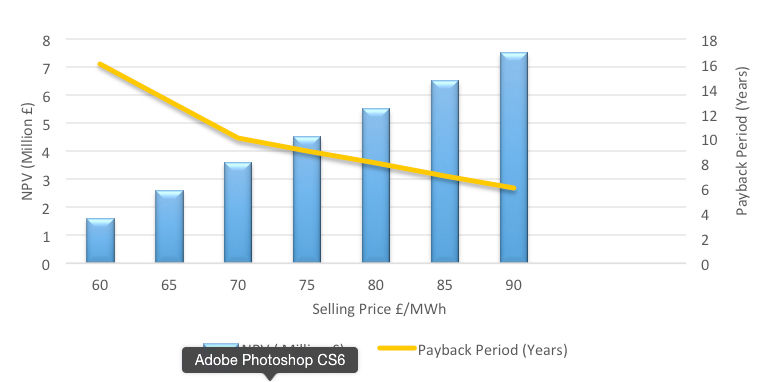

It is important to realise that this biogas plant will be implemented at a future point, however, there is no guarantee that the current electricity selling price of £75/MWh will stay fixed, hence, to examine the consequence of electricity selling price in the future against the net present value and the payback period; a sensitivity analysis for 2030 was performed.

As an example, the analysis revealed that the plant could be more profitable if the selling price increased to £90/MWh, which means the net present value would reach £7.5 million and the payback period would drop to nearly 6 years. Refer to Figure 1.

The key summary to taken after performing the above- mentioned financial analysis of the anaerobic digestion plant, is the plant can be profitable in areas where organic waste is abundant, and the local government willing to take responsibility and collaborate in separating the waste and provide enough collection points. This can help in creating improved waste management infrastructure, alongside opportunities for future investment.