In order to analyse the position of the UK biofuels industry, both in terms of policy and production, we must have a

benchmark against which we can judge the relative success (or failure) of the British biofuel industry. The benchmark

for the UK must be her fellow EU countries (especially France, Germany and Austria), as for the most part they are

comparable both in an economic and climatic sense.

To perform such a study this one must acquire an understanding of the EU’s policy (on biofuels) and then investigate

the course of action taken by EU member states in their bid to implement a successful biofuels industry. Using previous

production figures and other relevant strategic data we can measure Britain’s biofuel industry against that of her European

counterparts.

The utilisation of bio-fuels within Europe is not a new idea. In December 1985,

Council Directive 85/536/EEC, OJ L 334 12.12.1985, p.20 proposed that crude oil saving should be adopted through the use

of substitute fuel components in petrol. The directive stressed the importance of the role biofuels could play in reducing

Member States dependence on oil imports and authorised the incorporation into petrol of up to 5% ethanol by volume and

up to 15% of ETBE by volume. Some years later the European Union followed up these recommendations and so the ALTENER

programme on promoting renewable energies in the European community was adopted with the aim of securing a market share

for biofuels of up to 5% of total motor vehicle fuel consumption by 2005. It would take some time the EU enforced biofuels

quotas upon its members.

In September 2001 the Directorate – General Transport and Energy of the European Commission drafted a proposal for a

Directive of the European Parliament and of the Council on the promotion of the use of bio-fuels for transport. In essence,

the proposed directive aimed at increasing the use of biofuels for transport within the EU by requiring that a minimum

percentage of the total transport fuels sold in each Member State is biofuels in pure or blended form. By 2005, the minimum

share of biofuels should be 2 percent and should gradually rise to 5.75 percent by the year 2010 (these quantitative

commitments set out have not been applied before 2005 in order to allow sufficient time for Member States to establish

the necessary production facilities). In order to achieve this the directive gave Member States the option of applying

a reduced rate of excise duty to pure or blended bio-fuels.

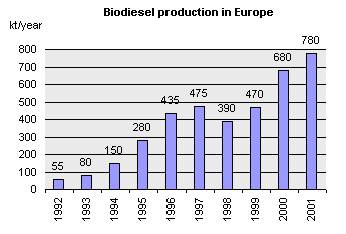

The introduction of the EU’s directive has led to a large increase in biofuels production, an increase of around 100 % over

the last five years. In 2001 780,000 tonnes of biodiesel was produced in Europe, mainly in Germany, France, Italy and

Austria. In 2001 they produced respectively 46%, 40%, 10% and 4%.

|

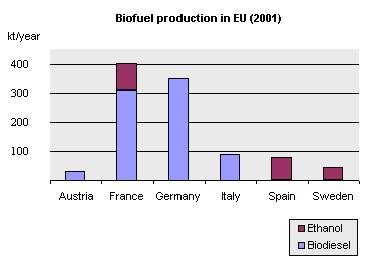

The EU has not only witnessed a growth in biodiesel production but also that of bioethanol. Bioethanol production in Europe has mainly taken a back seat to biodiesel but in 2001, 216 000 tons of ethanol were produced in Europe. Ethanol is mainly produced in France, Spain and Sweden with respective percentage of 42 %, 37 % and 21 %.

|

Austria has been a pioneer in establishing a bio-energy program, starting up already in 1991 one of the first biodiesel

production plants in the world. In January 1999 the Austrian Government decided to improve the basic conditions for the

introduction of biodiesel. A decision was therefore reached that by January 2000, fossil diesel fuel in Austria was to

confirm 2% biodiesel (at the time, Austrian diesel fuel consumption was 3.78 million tonnes so they calculated that a

blend of 2% would require 70,000 tonnes of biodiesel).

It took only a few months (April of 1999) before the decision process was truly initiated when a draft regulation on

transport fuels was worked out and discussed on a national level. By June 1999 drafts of two regulations were signed

by the Austrian Minister of the Environment and circulated throughout Austria and the rest of Europe. The first regulation

related to the quality of transportation fuels which allows the adding of up to 5% of biodiesel in fossil diesel fuel,

the second regulation dealt with a mandatory adding of 2% biodiesel in all diesel fuel.

However, consent was difficult to find on either a national or European level. In Austria the Ministry of Health, Work

and Social Affairs objected to the second proposals. While on a European level, objections were also raised about the

same point by France, Germany and Holland. It was therefore decided by the Austrian Government to reject the proposed

second regulation.

So in October 1999 the fuel regulations minus the contested regulation were published while an agreement was sought

with the industrial associations of vehicle importers and mineral oil traders. As some companies did not have any

experience with the use of biodiesel it was decided to limit the blending level to 3%.

The Austrian Government further stimulated the development of biofuels through the alteration of its fuel excise tax

system. From the 1st of January 2000 the utilisation of fuels from renewable raw materials is free of mineral oil taxes.

The Austrian Law on Tax Reform 2000 exempts the use of pure biodiesel and the blending of it, if it is used as sole (bio-)

fuel, provided:

Blends, which are less than 5%, in gasoline, or less than 2%, in diesel fuel, are taxed in the full amount. These measures have enabled Austria to produce around 30,000 tonnes of biodiesel per annum.

France (REF26)

A tax break on biofuels in France encouraged legal action from an oil company in 2000. BP took legal action against the

French subsidy for biofuels, claiming it was damaging their business. The European Court of Justice then accepted BP’s

argument against the tax break. France then appealed against the decision and petitioned the Commission for approval

of tax breaks on vegetable oils and agricultural ethyl alcohol derivatives used for heating and diesel. The commission

then approved the French request for a biofuels subsidy based on a different clause in the 1992 mineral oils directive.

Then in November 2001, the commission proposed draft targets for all member states to use 2.5% biofuels in place of

petrochemical fuels by 2005.

In France, TotalFinaElf is the only producer of ETBE (Ethyl Tertiary Butyl Ether) and VOME (Vegetable Oil Methyl Ester).

The oil company manufactured 200,000 metric tonnes in 2001 from plant-based ethanol, which is then added to premium

gasoline. The use of VOME, which cuts black smoke emissions when added to diesel fuel in sufficient quantities,

increased by 25% in France in 2001.

France is currently using 70% of its non-food set-aside land (410,000 hectares) for biofuel production – both biodiesel

and bioethanol. This has helped France to produce 300,000 tonnes of biodiesel and 100,000 tonnes of bioethanol in 2001,

thereby making France the largest biofuel producer in the EU.

Germany is the main biodiesel producer in Europe; it accounts for about 30% of EU biofuel production and has rapidly

expanded biodiesel production capacity over the last few years, with many additional projects planned in the future.

Current production is of the order of 350,000 tonnes per year, but Germany is looking to increase production to around 1

million tonnes over the next 3 – 4 years. However it is not clear how, if at all, this will fit the current EU legislation,

when the WTO / Blair House Agreement (The GATT Blair House agreement limits the production of oily crops to approximately

900,000 hectares of non-food crops in Europe) comes up for review, Germany may press for removal of the present

restrictions.

Germany operates a policy where no excise tax for biodiesel which substitutes standard fuels, either unblended or

blended with fossil diesel in the vehicle tank.

As part of a pilot project beginning in July 1998, Italy conducted a trial on the conditions for the use of biodiesel.

In April 2001, the Italian authorities applied to the European Commission to allow them to apply for an exemption

from excise duty on biodiesel and other biofuels. The period was to last for duration of three years from 1 July

2001 to 30 June 2004. Exemptions from excise duty were gained for a maximum of 125,000 tonnes of biodiesel per year.

Spain has invested heavily in the development of its bioethanol industry and is now producing around 400,000 tonnes

of ETBE, which is marketed around the whole of Spain. As a result of this Spain will cut their dependence on imported

oil by 200,000 tonnes.

The continued growth of biofuels in the EU will depend on a number of economic and technological factors, combined with

the set-up of adequate government measures to support the growth of biofuel production.

The gradual rise in EU biofuel production recorded over the last couple of years has only been possible because of the

proactive measures, both fiscal and promotional, taken in the various Member States concerned. Fuel tax systems are

very fragmented throughout the EU, and large differences exist among EU Member States with regard to specific tax

exemptions given for different fuel specifications. Greater EU harmonization in this field would bring stability

to the market and improve conditions for growth of the biofuels sector in general.

Also there are a number of key interacting factors, which have led to the commercial availability of liquid biofuels

in some European countries and not in others. The reasons are usually political, but the source of the “political will”

may vary, as we shall see next.