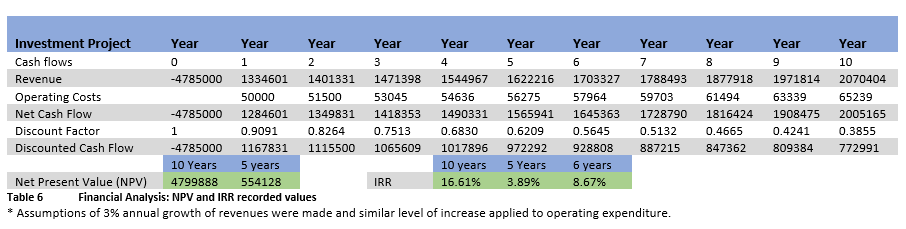

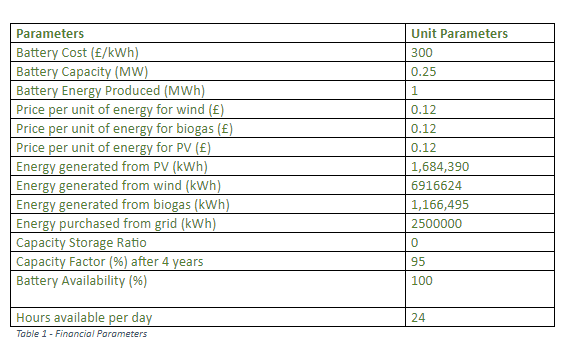

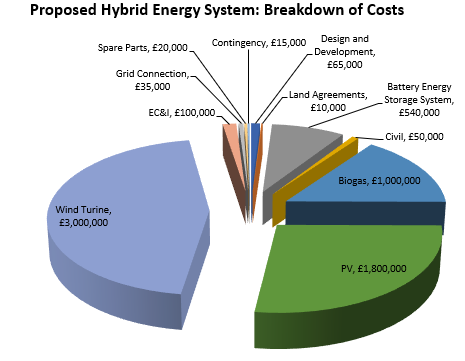

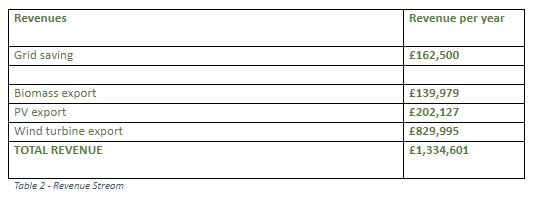

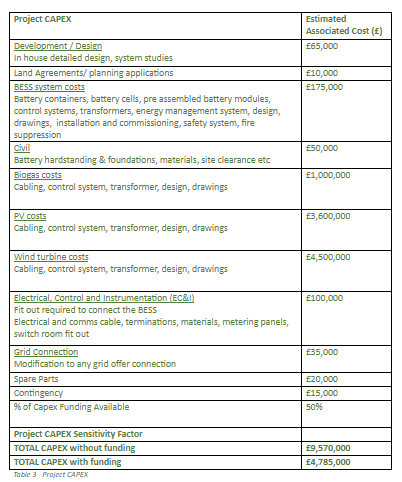

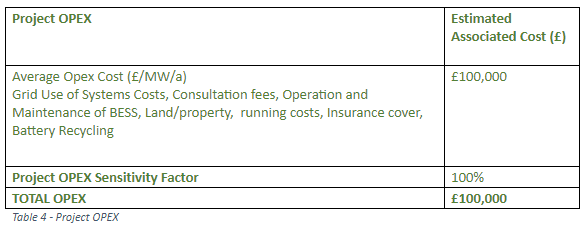

To establish feasibility of the proposed optimised hybrid energy system comprising of wind, solar, and biogas along with a Lithium-ion battery storage system, financial modelling of the system was undertaken. Parameters used in modelling calculations along with their associated measurement unit are recorded in table 1 below. Figure 1 below provides a visual representation of the anticipated cost of the system with component parts and their associated costs clearly detailed. CAPEX and OPEX calculations are detailed in table 2 and table 3 below. Breakdown of the revenue source is given in table 4. Financial Analysis of the project, including Net Present Value (NPV), Internal Rate of Return (IRR), Payback period, and conclusions drawn may be found in the investment appraisal section below.

INVESTMENT APPRAISAL

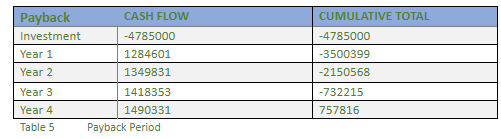

In order to fully assess feasibility of this project a number of investment appraisal techniques were applied. Payback period is used to determine at what point in time the project generates sufficient cash inflows to break even and recover the capital expenditure associated with the investment. Particularly important to the management of risk, this time-based measure calculates the period required for an investment to produce cash flows equal to the original investment cost, which in this instance occurs in year 4 of the project. Table 5 below provides data pertaining to the relevant cash flows. The payback period does not take account of the value of cash flows over time.

Net Present Value (NPV) provides a means by which cash flows may be discounted to reflect the time value of funds. NPV was applied to the proposed capital investment using a 10% discount factor over both a 5-year period and 10-year period. Table 6 below shows the calculated NPV for year 5 of the project will be £554,128. As NPV is a positive, the return achieved is greater than the rate at which the cash flows have been discounted (cost of capital, i.e. 10%), and therefore the project would be feasible. As the proposed project is deemed to be a long-term investment it is important to establish potential longer-term viability. NPV over a 10-year period had a calculated value of £4,799,888 suggesting an investment in the proposed system would be profitable.

Internal Rate of Return (IRR)

To establish the rate the investment project is achieving, an IRR calculation was applied over three different time frames; 5 years, 6 years, and 10 years. The IRR represents the percentage discount rate at which the NPV of the project would be equal to zero, i.e. the cumulative present values equal the initial outlay. An IRR of 3.89% was recorded at 5 years; 8.67% at 6 years; and 16.61% at 10 years. This is the expected compound annual rate of return that will be earned on the proposed project at the specified time frames calculated.