| Yearly cost: The net investment cost and maintenance will be compiled into a yearly cost for the duration of the loan. The duration of the loan is set at what would be a reasonable lifetime for the equipment. Revenue obtained assuming all electricity produced is sold at a given value.The value of the electricity produced will depend on whether there are feed-in tariffs.

◊ The feed-in tariffs in the UK for PV are:

- ≤4 kW new building --> 36.1 p/kWh

- ≤4 kW retrofit --> 41.3 p/kWh

- >4-10kW --> 36.1 p/kWh

◊ The feed-in tariffs in Italy for PV are:

- ≤3 kW partially integrated -->0.422 €/kWh

- ≤3 kW fully integrated -->0.470 €/kWh

- 3-20kW partially integrated -->0.403 €/kWh

- 3-20kW fully integrated -->0.442 €/kWh

There are other tariffs applicable for PV in Italy but they do not concern us for this study.

As these tariffs will not last forever and are expected to come down, we will look at financial viability for electricity value from average grid price to highest feed-in tariff.Net revenue: this is the revenue minus the yearly cost. Pay-back period at present (under feed-in tariffs / no grant) To look at the pay-back period for PV systems in Glasgow and Palermo, we have to make the right assumptions for the price of installed PV panels, which is difficult as there are quite a lot of different manufacturers and models and different prices for different efficiencies.

Our models were made according to the specifications (efficiency in particular) for BP panels. We have used the current list price (incl. tax) although we believe the PV industry should be continue to see a regular price (per kWp) reduction for a number of years in the future.

We have made assumptions regarding the installation cost based upon several published data available. We believe that in the very near future installation costs will come down in UK as they have in other European countries.

After consulting several people with relevant expertise as well, we believe the assumptions should fairly realistic for the present situation. PV installations ranging from 1 to 5kW with the following parameters:

◊ Equipment cost = £600 per panel (PV module BP 4175T --> 0.175Wp power output)

◊ Installation cost = £2000/kW down to £1500/kW for 5 kW

◊ Connection cost of £800 fixed

◊ O&M = 0.5% per year

◊ Loan interest = 2.5%

◊ Loan duration = 25 years

◊ We applied various two different feed-in tariffs for Glasgow

◊ For Palermo the tariff used is €0.47 (fully integrated PV below 3kW)

◊ No grant is assumed (The reason being that in the UK there is a £2500 limit for all renewable systems within the dwellings and therefore a grant may not always be accessible if it has been obtained before for other equipment. All countries do not have grants also at present. Grants will be looked at later)

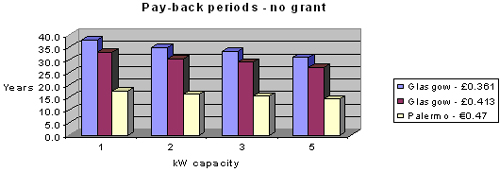

From this analysis, we obtain the above graph for which each colour represents a feed-in tariff price and the conclusions concerning our 2 case studies are: Glasgow

Based on the assumption that PV panels will last 25 years we see that in Glasgow the panels would barely pay for themselves only assuming a high feed-in tariff applicable to retrofit cases and lower installation cost for 5kW.

If the lower feed-in tariff applies (new building) then the pay-back period is near or above 30 years depending on the capacity (and the initial cost).

The capacity factor we have obtained in Glasgow of about 6.9% accounts for the long pay-back periods however the high initial cost also plays an important role in this, since the BP panels are not the cheapest equipment available.

While the capacity factor is not likely to change much (unless some breakthrough in improving the efficiency was made) we can probably anticipate some reasonable reduction in PV panel costs as well as installation costs mostly due to increased production volume and competition between suppliers. Palermo

Using the fully-integrated feed-in tariff the pay-back period in Palermo is much smaller than in Glasgow, due mostly to the higher capacity factor of 14.6%.

It is now possible to achieve pay-back period in the region of 15 years.

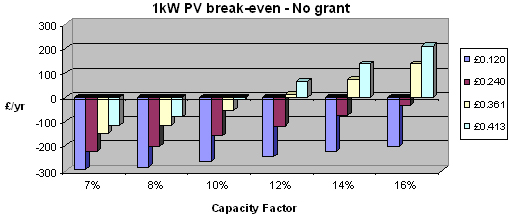

Also equipment and installation costs go down for PV panels. Break-even point for a 1kW system without a grant but under feed-in tariffs Obviously the pay-back period data is directly reflected in this chart (demonstrated below) but here we also can see what happens for locations with different solar potential energy and capacity factor. The costs and loan parameters are the same.

As expected without feed-in tariff PV do not break even anywhere, 16% capacity factor in Europe is representative of the best areas (Palermo is 14.6%).

Using the lower and higher UK tariff we need respectively 11-12% and 10% to break even over 25 years, which is probably not achievable in the UK.

Other countries with more solar potential have introduced higher feed-in tariffs (France, Germany, Greece) allowing to break-even relatively easily within 25 years.

We conclude here that in Glasgow a PV installation would be barely viable assuming a 25 years lifetime and no grant is obtained. However the lifetime should be longer than 25 years (especially as technology improves) and grants are available in UK (up to £2500 for the moment).

We can now look at way to reduce the pay-back period of PV in UK.

How could small PV be more viable in the UK? As the solar resource cannot be changed and the feed-in tariffs are rather high already, we can only look at 2 separate parameters to see whether PV can become viable:

a) A lower investment cost

b) A longer lifetime of the equipment.

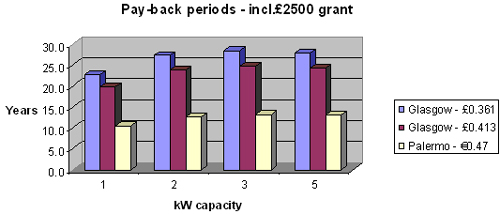

Influence of equipment cost We first introduce a grant of £2500 (applicable in UK), limited to 50% of cost.

The grant represents a high proportion of the 1kW installation (about a third) but a lower proportion of larger systems cost. We can notice from the following graph that as a result the 1kW installation now has the shorter pay-back period.

We note also that all schemes pay-back periods drop below 25 years under the high feed-in tariff and below 30 years under the lower feed-in tariff.

In Palermo the pay-back period for a 1kW installation would fall below 10 years if the same grant scheme was available.

Many countries have a higher scheme of grants than UK, in France for instance 3kW installation can obtain about €6k grant making the pay-back period near 10 years for the South part of France. The other option to reduce the initial investment is to make assumptions on progressive price reductions from the industry. PV panel prices have been dropping regularly over the past years and will likely to continue doing so, as manufacturers of PV panels improve the equipment efficiency and optimise their production cost.

We believe that the price/kWp will drop significantly within 1 or 2 decades, however so will the feed-in tariffs!

Feed-in tariffs are basically set in order to make the product attractive in areas where the production is sufficient and they are updated regularly. We believe that governments will drop feed-in tariffs as prices drop so to make things break-even (on national average).

Palermo in our case-study does very well because it benefits from higher solar potential than average for Italy.

As a result we do not consider it useful to model future drastic reductions in equipment cost as we do not believe the feed-in tariffs will be there anyway and pay-back period are not likely to change.

Based upon the highest UK feed-in tariff we see that we require a capacity factor of about

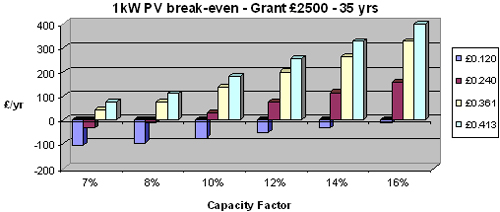

A longer lifetime of the equipment ♦ We model PV systems of 1kW assuming a lifetime of 35 years and that is shown in the graph below. As previously the left column represents the net yearly income so positive values show the system pays itself before the lifetime is over.

The loan duration is taken as the same as the lifetime.

The smaller system if installed in Glasgow (~7% capacity factor) is still not viable without the feed-in tariff. However with the low fed-in tariff it is quite viable and yields a positive yearly net income. Assuming a similar loan would be available in Palermo(~15% capacity factor) we see that the system is nearly profitable even without feed-in tariff. This is quite interesting because long term we can anticipate that:

- PV costs will drop (steadily)

- Lifetime will increase (slowly)

- Efficiency will increase (slowly)

- Normal grid prices will increase (possibly dramatically)

So basically this shows that in areas with good solar potential PV could become viable without feed-in tariffs quite soon.

In the UK assuming 8% capacity factor average this system become viable if the value of electricity reaches £0.24 per kWh, whether it is with a feed-in tariff or due to grid price increase, or both.

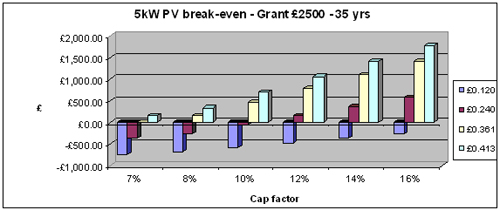

◊ Now the PV modules are of 5kW having a lifetime of 35 years. The following graph demonstrates the results concerning this system.

The larger system benefits less in proportion than the smaller one from the fixed £2500 grant, the grant here has a small effect. As a result we barely break even in Glasgow under the low feed-in tariff of £0.361.

Without feed-in tariff the system do not break even in the better European locations, however if electricity value was double at £0.24 (a reasonable future tariff or maybe even grid price), then we break even at a capacity factor of 10-11% which means the PV would be viable for quite a large part of Europe.

Conclusions

- In Glasgow a PV installation is barely viable under current feed-in tariff, if we assume a 25 years lifetime and no grant is obtained.

- In Palermo the pay-back period for a 1kW installation would fall below 10 years if the equipment cost was 30-35% less (either through a grant or equipment price reduction). This assumes current Italian feed-in tariff.

- A PV system with a 35 year lifetime at roughly the current cost of installation would be financially viable if the value of electricity was £0.24 in most of Europe south of UK (£0.24 is a reasonable assumption for longer term feed-in tariffs or grid price).

- A PV system with a 35 years lifetime at a cost about 30-35% cheaper would be viable in Glasgow if the value of electricity was higher than £0.24

|